From the tailings of large open pit mines and omnipresent data centers to the over-concentration of capital in the hands of the few, we appear to be in an age of accumulation, feeling the weight of what once seemed so light. The internet and information has become concrete, literally utilizing the sand and metals of our earth to transmit its data in a manner not so different then constructing roads and buildings. So much weight makes us dream of being plastic and light, mobile, modulatory, capable of bearing all these materialities while continuing to sustain the technical and economic fantasies of eternal growth and novel change. It is perhaps of little surprise then, that since the 1970s, it is the word “resilience” that has become the figure of hope for planners, entrepreneurs, policy makers, and environmentalists alike. Resilience is a system’s ability to absorb shock and continue functioning. The best system is the one that can bear the weight, if we will, of dynamic change and flexibly respond to the accumulations of population, matter, contaminants, and money. The best ecology is one that can keep operating under a lot of pressure.

The 1970s marked the rise of another myth-reality, that of finance capital and derivatives. Finance is often presumed to be feather light and mobile, unattached to earthly matters. While financial instruments are often argued to be detached from the social and material processes that make commodities—understood as money making more money—as the recent 2008 “crisis” demonstrated, nothing could be further from the truth. Derivatives are financial instruments that allow a certain amount of something (mortgages, tables, anything) to be traded at some point in the future at an agreed upon price. One can also, for example, bet on the cancellation of an order, or some other event changing the future price of the underlying commodity or security, and so forth. The result is that the size of derivatives markets exceeds the world’s GDP by twenty times. Despite being seemingly abstract and delinked from the present, derivatives also drive human actions. People build homes, take mortgages, and subsequently suffer when these markets move. As cultural theorist Randy Martin has argued, rather than separating itself from social processes of production and reproduction, the derivative actually demonstrates the increased inter-relatedness, globalization, and socialization of debt.1 By tying together disparate actions and objects into a single assembled bundle of reallocated risks to trade, derivatives make us more indebted both to each other and to the earth itself, which is often the literal matter of such exchanges.

What then is the relationship between speculation and resilience? Our contemporary condition, often labeled the Anthropocene, has unveiled the geological materiality of those things considered social and technical—financial instruments, digital media, and information economies—and forced us to ask by what tactics and strategies, by what affective techniques, do we continue to speculate upon earthly destruction? How might we think together the seeming incommensurability of the material weight and geological timeliness of our earthly actions with the speed and mobility of globalized, computational, and machine traded capital? These questions emerged for me, quite viscerally, in the course of doing field work on the topic of logistics and smart cities. I became concerned with the forms of speculation and hope that continue to facilitate the on-going penetration of computation—both in terms of “smart” cities, grids, logistical systems, and finance—into the earth. For architecture, the question becomes one of thinking how time and space are organized to allow for the continuous operation of development and design when there is a widespread recognition that current forms of urban planning, growth, and development are injurious to human and other forms of life. In order to begin confronting the logics of derivation, extraction, and speculation on negative futures, ones that accept the sacrifice of certain lives as necessary and justified for survival and even growth—what I am labeling “resilient hope”—I want to discuss two scenes from my research: one in West Bengal, India and the other in New York City, United States. While seemingly disparate, thinking through these sites as related to both financialization and extraction might offer us a better understanding of the forms of hope and speculation currently allowing us both to continue myths of economic and technical growth while embracing a future understood as finite and catastrophic.

Disaster Speculation

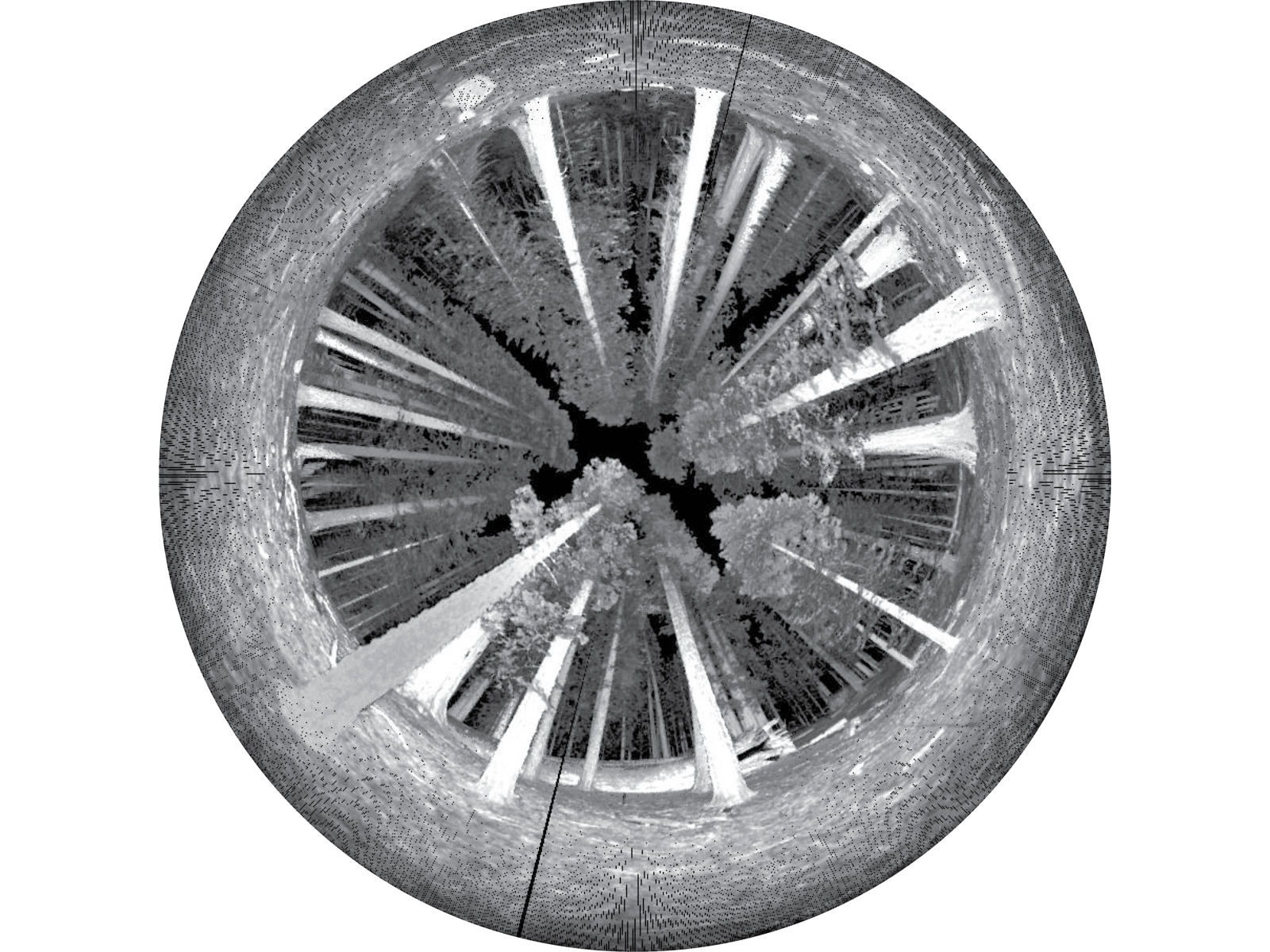

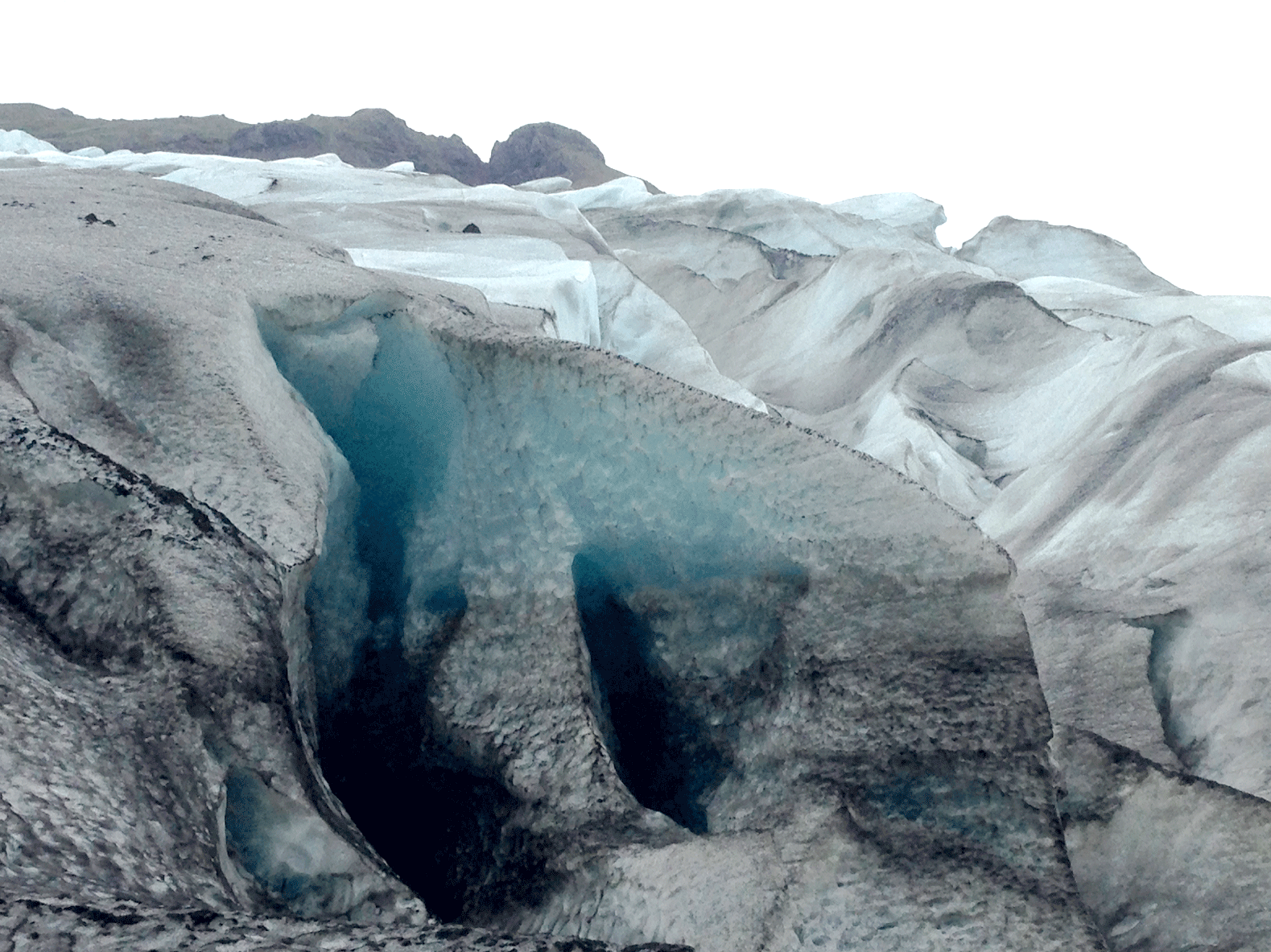

In March of 2016 I went to West Bengal to investigate both urban development in Kolkata and how Chinese capital is reformulating territory.2 One site I visited was the city of Siliguri, located at the border between China, India, Nepal, and Bangladesh on a floodplain of the Himalayas, and therefore an essential component of the vast river systems that are central to life throughout the region. It is also a major site for the extraction of boulders and sand from the river beds that are used for road and building construction, of which there is currently a great deal of throughout the region. The Asian Development Bank has been investing large sums of money to develop a new “silk road” as part of a broader Asian Highway plan to increase and improve infrastructure throughout South and Southeast Asia. Accompanying this speculative infrastructure is also a real-estate development boom largely catering to foreign investment. Both the roads and condos demand massive financing and, of course, concrete. Concrete, in turn, demands sand particles that are clean, smooth, hard, and without clay, chemical coatings or other contamination. To make concrete one must use sand worn by water, which is usually dredged from a river or seabed. A multitude of often disposable laborers working under deplorable conditions endlessly mine sand from local riverbeds, sinking water levels around Siliguri into the earth, drying up, and threatening a major source of water for much of India and Bangladesh.

Some 600 kilometers to the south lies Kolkata. One of the largest and densest settlements on Earth, the city was central to the development of capitalism and has long been at the heart of global trade and commerce. Situated between Kolkata’s IT park in Sector 5 and the airport lies Rajarhat “New Town.” Rajarhat was developed as a space for high-tech corporations and the luxury housing speculatively desired by their workers, but neither the high-tech industry shifted its central operations from other cities such as Bangalore nor did a large number of foreign corporations open their offices there. With foreign corporations being slow or reluctant to relocate, what exists in Rajarhat today are secondary service providers to central operations located in Bangalore and elsewhere. Not only did Rajarhat never achieve the designation of “smart city” it was supposed to, but some of the developments are not even hooked into the information and bandwidth infrastructures that are their purported raison d’être. While much of the new housing in Rajarhat (not to mention across India) has never been (and might never be) occupied—having been bought solely for speculation by domestic and foreign investors—construction continues full speed ahead on luxury condos and office parks. One of the more graphic demonstrations of this disjointed development came on 31 March, 2016 when one of the recently built overpasses collapsed. Many were killed as the result of overly rapid construction (which in this case means poor quality concrete), corruption, and the velocity of speculation and derivation in the real estate sector.

This rapid speculation emanates from the fact that most of these developments, both the office parks and the residential towers, are heavily leveraged. In a pattern repeated throughout the subcontinent, long before ground was ever broken both the debt and cost to the state and developers had likely been credit swapped with profits reaped by large investment banks located in the global financial hubs of Mumbai, New York, Frankfurt, and London.3 While the function of zones such as Rajarat beyond financialization is unclear, as a result of the complex and entangled histories of caste, colonialism and capitalism, their development has already cost some 30,000 people their homes. Since previous inhabitants were from lower castes and never owned the land, dispossession by eminent domain was easy, and often with little remuneration. As a result, these people are forced to relocate and occupy the ubiquitous shanty towns of Kolkata, seeking transitory work in locations such as the port where they often supply, under enormous duress, the kind of labor that in other contexts would be automated. Lacking any public health, sanitation infrastructure or electrical grids, these individuals are literally worked to death. With their bodies no longer capable of unloading and loading the ships with the efficiency and productivity necessary, dock workers are forced to retire by their late thirties.

Rising Currents

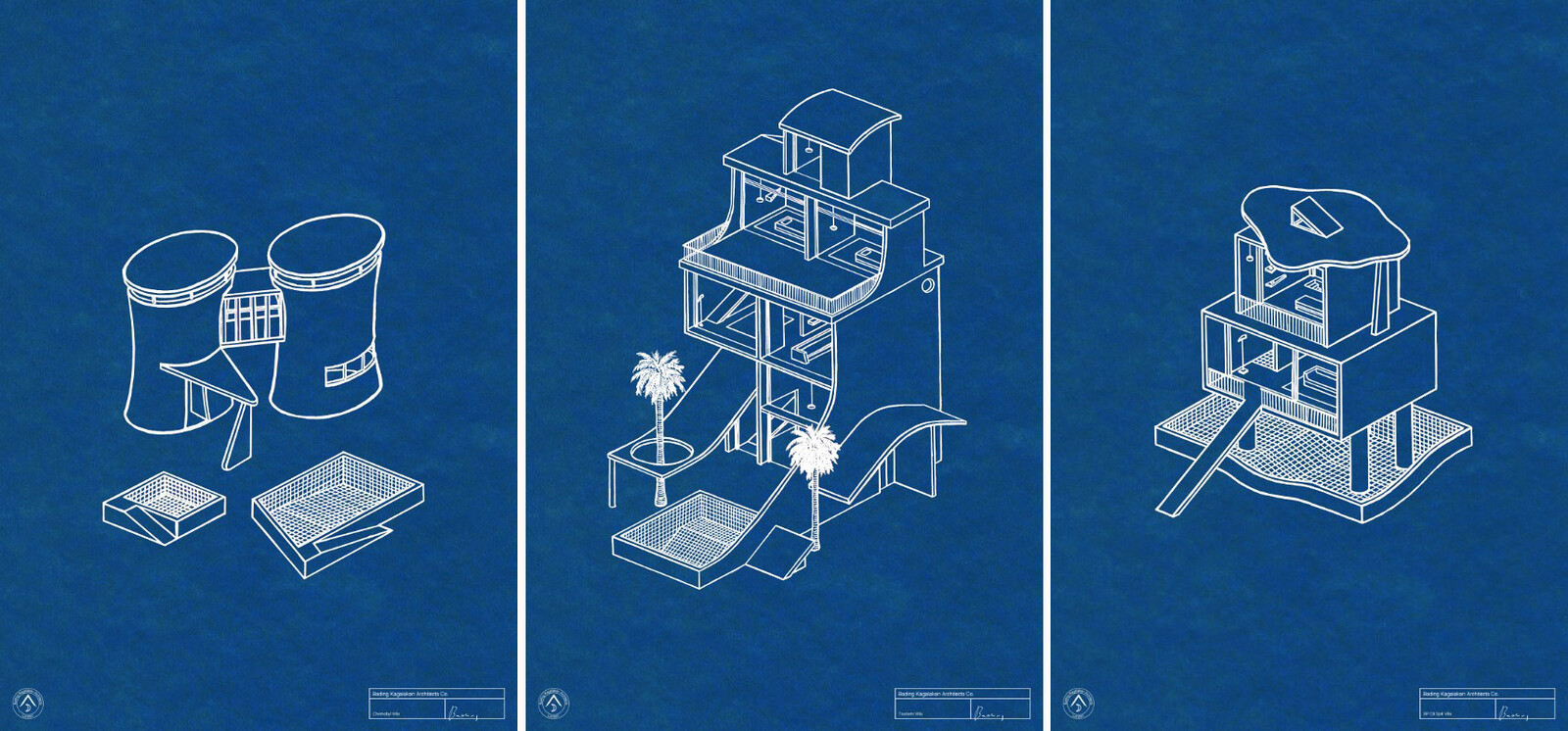

Mirroring these scenes of graphic, territorial-scale violence are another set of marketing, technological and logistical endeavors that take part in a positive speculation on precarity and environmental destruction. One of the more recent demonstrations of hopeful speculation focused on the future devastation of New York City. The 2010 Rising Current exhibition at New York’s Museum of Modern Art took place moments before the real hurricane Sandy hit. One of the most popular projects exhibited was Oyster-tecture by Kate Orff/SCAPE, a project that has gone on to be funded to the tune of sixty million dollars.4 The project, sited at Brooklyn’s Gowanus Canal, proposes to grow oyster reefs as ecological barriers. The very recruitment of an organisms’ body for and as infrastructure poses historically situated questions about what makes this new mode of managing speculation, populations, and futurity novel? And how are these forms of speculation related to the discourse of “resilience”? The irony is that in serving as infrastructure, the oysters would slowly die off as a result of their dirty and inhospitable environments, with rising water acidity and temperature. This state of being used to death perhaps even goes beyond the terms most often invoked to critique neoliberalism such as extraction and subsumption. This death, beautifully rendered by the architects, embraces not only this terminal destruction as aesthetically pleasing, but also the now-assumed inevitable destruction of much of New York by tidal waters.

Another project in the same exhibition, New Aqueous City by nArchitects, repeats this theme of destruction made visible and pleasing with a proposal for new zoning strategies and the literal use of “bottom up” design strategies, such as placing floatation devices on the bottom of buildings and sea walls.5 The video that accompanied their proposal depicted a storm surge and narrated, by way of the architectural intervention, its survival. As the waters rise, new real estate and agricultural opportunities open. When the big storm finally hits, we see individuals calmly gathering on the roof of what appears to be a fancy condominium, prepared for evacuation. As the helicopter swoops down, all is beautiful; the light is gentle, there is no wind or rain. It looks rather pleasant. These images resemble nothing of the devastated environment that Hurricane Katrina wrought on New Orleans, which unlike Sandy, had people actually being evacuated by helicopter. In light of such historical referents, one cannot help but wonder who would be left behind?

Resilient Logics

From the recent fetish for making architectural renderings look used, dilapidated, or degrading to reports by groups such as Deutsche Bank claiming the potential risks and rewards for investors created from climate change, there is a new sentiment emerging of positive affect for negative futures. These images are indoctrinated by what I want to label “resilient hope,” an emergent paradigm that links high-tech computational infrastructures of ubiquitous computing and “smartness,” data centers and finance, to the more “concrete” extractive or exploitative economies of bodies, such as those in West Bengal or New York City. Combined together, resilience and technology create a form of preemptive infrastructural governance that naturalizes precarity, sacrifice, and violence as a necessary economic value, rather than as a politically derived option.

Resilience has a peculiar logic. It is not about a future that is better, but rather about an ecology that can absorb constant shocks while maintaining its functionality and organization. Following the work of Bruce Braun and Stephanie Wakefield, it is a state of permanent management without ideas of progress, change, or improvement.6 The irony is that this hopeless situation is actually met with hopeful speculation, usually through new forms of temporal management in finance and technology. Real estate speculation can thus continue to occur on new silk roads and never-occupied “smart” developments even as the Himalayan floodplains are destroyed; the end never arrives, but is simply delayed or, more appropriately, derived.

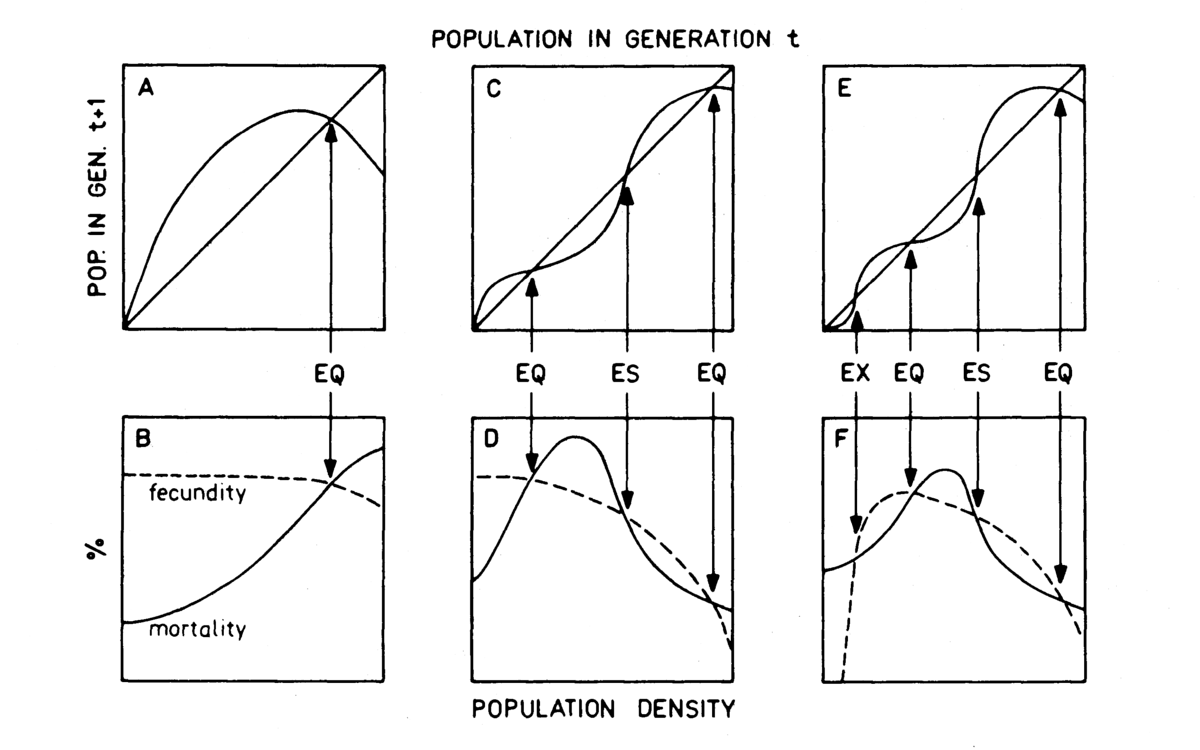

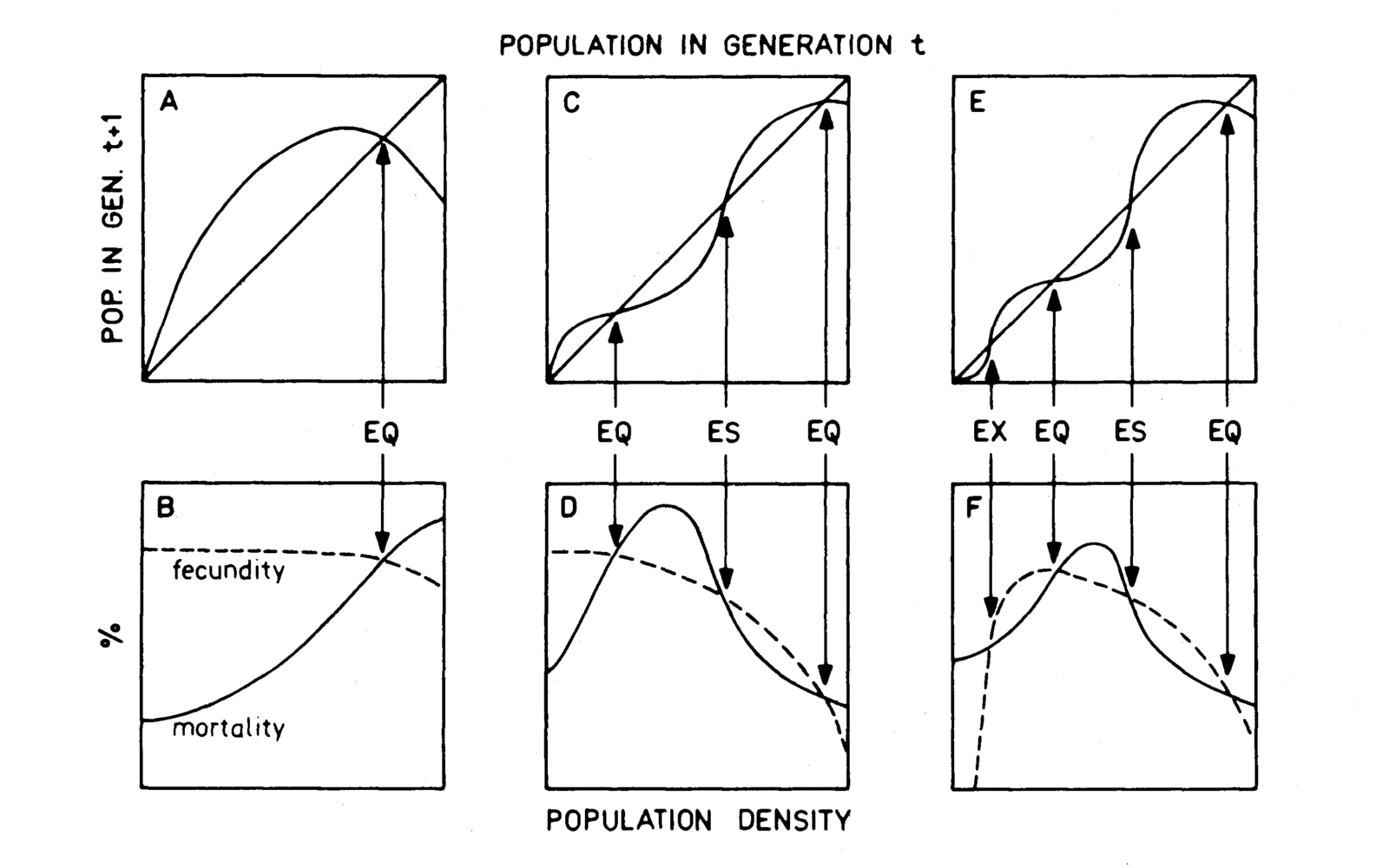

Resilience plays important roles in many different fields, ranging from economics to engineering to forestry.7 The understanding of resilience most crucial to this discussion is the one that was first forged in ecology discourse during the 1970s, and especially in the work of C.S. Holling who established a key distinction between “stability” and “resilience.”8 Working from a systems perspective and interested in the question of how humans could best manage elements of ecosystems that were of commercial interest (e.g., salmon, wood, etc.), Holling developed the concept of resilience to contest the premise that ecosystems were most healthy when they returned quickly to an equilibrium state after being disturbed. Holling called the return to a state of equilibrium “stability,” but argued that stable systems were often unable to compensate for significant and swift environmental changes. As Holling put it, the “stability view [of ecosystem management] emphasizes the equilibrium, the maintenance of a predictable world, and the harvesting of nature’s excess production with as little fluctuation as possible.” Yet this very approach assures that “a chance and rare event that previously could be absorbed can trigger a sudden dramatic change and loss of structural integrity of the system.”

Resilience, by contrast, denoted for Holling the capacity of a system itself to change in periods of intense external perturbation as a mode of persistence. The concept of resilience enabled a management approach to ecosystems that “would emphasize the need to keep options open, the need to view events in a regional rather than a local context, and the need to emphasize heterogeneity.” Resilience is, in this sense, defined in relationship to crisis and states of exception; that is, it is a virtue when such states are assumed to be either quasi-constant or the most relevant for managerial actions. Holling also underscored that the transition from valuing stability to valuing resilience depended upon an epistemological shift: “Flowing from this would be not the presumption of sufficient knowledge, but the recognition of our ignorance: not the assumption that future events are expected, but that they will be unexpected.”

Contemporary planning, finance, and design practice abstract the concept of resilience from an ecological systems approach and transform it into an all-purpose epistemology and value. These fields posit resilience as a general strategy for managing uncertainty without endpoint, while also presuming that our world is so complex that unexpected events are, indeed, the norm. Resilience also functions in the landscape of planning and management to collapse the distinction between emergence (which would simply denote something new) and emergency (which denotes something new that threatens). In this sense, the terms operates in the interest of producing a world where any change can be technically managed and assimilated while maintaining the ongoing survival of the system, even at the cost of its particular components, be they individuals, ecosystems, or species.

Nowhere is this better exemplified than in the aforementioned examples of New York City, where the slogan after Hurricane Sandy’s devastation in 2012 became “Fix and Fortify.” A clearer statement about the stance of urban planners towards geo-ecological trauma could perhaps not be found. Planning, it is posed, must assume and assimilate future, unknowable shocks, ones that may come in any form, including threats to security, economies, or environments. In the cases discussed, the real destruction of New York was initially taken as an opportunity for innovation, design thinking, and real estate speculation. For the exhibition, the cities’ premier architecture and urban design firms were asked to design for a city ravaged by sea-level rise as a result of global warming, about which MoMA’s discourse was abundantly positive:

MoMA and P.S.1 Contemporary Art Center joined forces to address one of the most urgent challenges facing the nation’s largest city: sea-level rise resulting from global climate change. Though the national debate on infrastructure is currently focused on “shovel-ready” projects that will stimulate the economy, we now have an important opportunity to foster new research and fresh thinking about the use of New York City’s harbor and coastline. As in past economic recessions, construction has slowed dramatically in New York, and much of the city’s remarkable pool of architectural talent is available to focus on innovation.9

This rather stunning statement turns economic tragedy—the labor crisis in architecture after 2007—and the imagined coming environmental apocalypse into an opportunity for technical, aesthetic and economic speculation. It is a literal transformation of emergency into emergence; a model for managing perceived and real risks to the population and territorial infrastructure, not by “solving” the problem but through absorbing shocks and modulating the way the environment is managed.

Such logics pervade the landscape of large logistical and computational environments. Returning to the initial example of the imagined, never realized, high-bandwidth smart city of Rajarat, the development of so-called smart cities follows a logic of software development. That is, every present state of the smart city is understood as a demo or prototype of a future smart city; every operation is understood in terms or testing and updating. As a consequence, there is never a finished product, but rather infinitely replicable, yet always preliminary versions of these cities around the globe. Engineers openly speak of these cities as an “experiment” and as a “test,” admitting that the system did not work but could be improved in the next instantiation elsewhere in the world. This idea of the infrastructure as “demo” avoids any actual questions of whether this construction impacts the planet, labor, or its inhabitants, and opens the door to assimilate any difficulty or challenge into the next version by way of deferral. This design logic allows the management and negotiation of risks through derivation (from an imagined origin) in a manner that avoids ever having to finally encounter or take responsibility for the impact of respective events—whether weather, economic, or security. This evasion of encounter with the world happens because the credit has been swapped, or the version already rendered obsolete before anyone can take the time to evaluate the implications of the original bet or question the actual process being deployed. If a prototype “fails,” which is to say is found ecologically or economically sub-optimal or un-resilient, then this failure does not provoke a widescale structural change in approach (for the next development has already been planned), but rather a modulation of current strategy; an assimilation of the adverse event, or any other forms of resistance, into the next model while maintaining the basic operations of the ecology or system the same. Derivation and resilience are thus wed. The sub-prime mortgage “crisis” of 2008 might serve as exemplar, as from the logic of the derivative there was no crisis, and in fact nothing changed. What is true of finance also often holds true today for urban planning and development.

Resilience and Derivation

The concept of resilience is tied to the concept of a future that is always a version, perhaps a derivative replica, of another moment. This is a concept of time where difference is not historical or progressive, but repetitive in practice while producing constantly differing territories. This is a self-referential difference, only measured or understood in relation to the many other versions of smart cities, all built by the same corporate and national assemblages. Such self-reference in terms of evaluation married to the management and curtailment of temporality into very short intervals mitigates the need to actually find out the “true” value or the actual impacts of a project, an investment, or a bet on the world. As Melinda Cooper has noted in discussing weather futures, contemporary markets have now produced derivatives that are literally producing value from betting on adverse and unpredictable events in relation to one another rather than as discrete occurrences with lived impacts. As she notes,

As a futures methodology, scenario planning is designed to foster decision-making under conditions of uncertainty. Its focus is not risk as such, but rather the radical uncertainty of unknowable contingencies—events for which it is impossible to assign a probability distribution on the basis of past frequencies…In the process, it is the very relationship between the measurable “substance” of the commodity—its stored value—and the event-related nature of price that is reworked: where traditional derivatives contracts traded in the future prices of commodities, financial derivatives trade in futures of futures, turning promise itself into the means and ends of accumulation.10

Time here becomes not a relationship to the spatial circulation of goods, labor, and commodity, but a thing-in-itself, a non-historical, but also non-geological or environmental time. Time has become a pure ecology of self-reference. The equation Cooper implies is somewhat new. She argues that if before, at least since the nineteenth century, the futures markets bet on the change in price over time of a commodity, now we bet on time itself. This future is not one that can be predicted, as it does not rely on past data. Financial markets therefore “hedge” bets. Derivatives can be traded and profits made long before we know the results of the investments. Those who re-package and circulate risks (as again with mortgage markets, but now also markets in insurance and weather futures) are furthermore betting on agglomerations of dispersed risks and futures, not on the relationship between the “measurable substance” or “stored value” of a commodity and its future price. This provokes new practices, most significantly around measurement, since time no longer equals money but rather money derives from time itself. The form of time here is speculative, not predictive. This logic assumes physical form through engineering and design and the production of test-beds, demos, or prototypes; speculation on a future that is always multiple and elastic. Perhaps that explains why there is a seeming love of animation and re-narration of disaster in these architectural projects mentioned above; the constant reminder that change itself is a medium for speculation. If the Cold War was about testing and simulation as a means to avoid the unthinkable, yet nonetheless predictable (nuclear war), the formula has now changed.11 This is best summarized by the distinction between risk and uncertainty first laid out in the 1920s by economist Frank Knight. According to Knight, uncertainty, unlike risk, has no clearly defined endpoints or values; it offers no clear-cut terminal events.12 What follows is that the test no longer serves as a simulation of life, but rather makes human life itself an experiment for technological futures. This “uncertainty” embeds itself in our technologies, both of architecture and finance. Thus, in financial markets we continually “swap,” “derive,” and “leverage” never fully accounted for risks in the hope that circulation will defer any need to actually represent or confront it. In infrastructure, engineering, and computing, we do the same. We prototype, develop, and demo, whether in building management systems or “smart” infrastructure. We optimize and make resilient environments through a self-referential calculus that compares performance only to the previous version of a building, electrical grid, and so forth. The entire discourse of “smart” cities is invested in evading top down planning in the interest of offering a data-driven system that literally uses its population as resource, medium, and test-bed for new forms of development, extraction, speculation, and indeed, life itself.

As future risk transforms into uncertainty, high technology, and particularly “smart” and “ubiquitous” computing infrastructure becomes both the language and practice to imagine our future. Instead of looking for utopian answers to our questions regarding the future, we focus on quantitative and algorithmic methods, on logistics, on how to move things, not on where they end up or the impacts of these actions. Resilience, now married to infrastructures of ubiquitous computing and logistics, becomes the dominant method for engaging with possible urban collapse (and also the collapse of more sui generis infrastructures of transport, energy grids, financial systems, etc.). At the same time, terms like “smartness” become a new catch phrase for an emerging form of technical rationality that, by continuously collecting data in a self-referential manner, is able to constantly defer future results or evaluation and assume the responsibility of managing this structurally uncertain future. What results is the development of forms of financial instrumentation and accounting that no longer need to engage with, alienate, or translate extraction from a historical, geological or biological framework of value.

One of the key (and troubling) consequences of these two operations that now shape and form many logistical territories—the practice of demoing, prototyping, and versioning the imaginary and a discourse of resilience—is that they obscure differences in kinds of catastrophes. While every crisis event—for example, the 2008 sub-prime mortgage collapse or the Tohoku earthquake of 2011—is different, within the demo-logic that underwrites the production of smart and resilient cities, supply chains, and infrastructures, catastrophes all appear the same. Differences are subsumed under the general concept of on-going crisis without clear event structure. It is precisely this evacuation of differences, in both temporality and societal structure, that is most concerning in confronting the extraordinary rise of ubiquitous computing and high-tech infrastructures—either as solutions to political, social, environmental and historical problems in urban design and planning or as engines for producing new forms of territory and governance. This logic also prompts us to ask about the possible alternatives: can we narrate alternative histories? Can we produce different environments and designs that create encounters with loss and the ruins of our planet in a manner that allows us to imagine actions other than the continued and resilient circulation of capital? What is needed is to fundamentally transform the current practice of deferring negative futures through demoing to another mode. This demands beginning to examine the social movements, construction projects and many efforts in art, architecture, design, the humanities, science and politics, that have challenged the positive embrace of end times and fought to reintroduce other forms of time and life into space.

This returns me to the opening scenes and to contemplate the ethical and political implications of a world where derivation, extraction, and resilience are wed in a manner that has turned the planet and all its forms of life into a massive medium for the development of “smart” technologies. When concrete first emerged as an ideal material in modern architecture and in art, it was in the interest of producing another world that was not yet here: utopia. Today, we face a different challenge, one of imagining another world while recognizing the tragedy that already has, and still is occurring to most of life on earth. This demands a change of tense for design and politics. A new imaginary, and new tactics for rethinking the forms of futurity we wish to inhabit, also demands a different relationship between how we are understanding financialization, ecology, habitat, and environment. Finance does not replace the social or our connection to the world but could, as many suggest, actually serve as a site by which to recognize how seriously internetworked and co-dependent we are, not to mention how thoroughly produced and socially contested the forms of debt to each other and the planet are.13 Making ourselves indebted in new ways to the many Others that occupy the earth might open to not merely a negative speculation on catastrophic futures but to forms of care, which are increasingly becoming imperative. A close examination of finance, environment, and habitat might become the bedrock by which to begin envisioning and creating new futures. We cannot dream of creative destruction, since we have indeed already destroyed the world, but nor can we continue to embrace a world without futures.

Randy Martin, “What Difference do Derivatives Make? From the Technical to the Political Conjuncture”, Culture Unbound, Volume 6, 2014: 189–210.

This research trip was conducted as part of the “Logistical Worlds” research project. See ➝.

Actual information about the financing of the Rajarat development is difficult to find. Data referenced here about the lack of occupancy and the probable financing came from discussion with the Kolkata Research Group members Ranabir Samadar and Mithelesh Kumar on March 31 and April 1, 2016. See ➝ for further research on the zone produced by the Transit Labor project, directed by Brett Neilson and Ned Rossiter.

See ➝.

See ➝.

Bruce Braun and Stephanie Wakefield, “Living Infrastructure, Government, and Destituent Power,” unpublished conference presentation at Infrastructure, Environment, and Life in the Anthropocene Conference, Concordia University (October 19–20, 2015): 1–16.

Since the nineteenth century, the “modulus of resilience” has served in material sciences as a measure for the capacity of materials such as woods and metals to return to their original shapes after an impact. In other fields, resilience tends to name ways in which ecosystems, individuals, communities, corporations, states, etc. respond to stress, adversity, and rapid change.

C. S. Holling, “Resilience and Stability of Ecological Systems,” Annual Review of Ecological Systems 4 (1973): 1-23.

See ➝, emphasis mine.

Melinda Cooper, “Turbulent Worlds: Financial Markets and Environmental Crisis.” Theory, Culture & Society 27, no. 2–3 (2010): 167–90: 173-78.

It is important to recognize that there are also alternative histories of temporality and control within computing coming from cybernetics. In the work on organizations and economics from figures such as Herbert Simon, and in the work on neural nets coming from the heritage of Warren McCulloch and Walter Pitts, ideas of “Fuzzy” problems and logic were prevalent, and preemption, not prediction, was a dominant theme. These influences went on to be very important and influential in engineering and financial culture, particularly through the figure of Nicholas Negroponte and through architectural collectives such as Archigram and the Metabolists. For more information see: Orit Halpern, “Cybernetic Rationality,” Distinktion: Scandinavian Journal of Social Theory 15, no. 2 (2014); Judy L. Klein Paul Erickson, Lorraine Daston, Rebecca Lemov, Thomas Sturm, and Michael D. Gordin, How Reason Almost Lost Its Mind: the Strange Career of Cold War Rationality (University of Chicago Press, 2013).

Frank Knight, Risk, Uncertainty, Profit (Boston: Schaffner and Marx Houghton Mifflin, co., 1921), ➝.

Similar arguments in relation to derivatives and credit swapping have been made by David Graeber in Debt: The First 5000 Years (New York: Melville Press, 2011), and ibid., Martin.

Accumulation is a project by e-flux Architecture and Daniel A. Barber produced in cooperation with the University of Technology Sydney (2023); the PhD Program in Architecture at the University of Pennsylvania Weitzman School of Design (2020); the Princeton School of Architecture (2018); and the Princeton Environmental Institute at Princeton University, the Speculative Life Lab at the Milieux Institute, Concordia University Montréal (2017).

A shorter version of this piece appeared on the Logistical Worlds blog in February 2017. Special thanks to Brett Neilson and Ned Rossiter for supporting this research through their ARC grant “Logistical Worlds” and who gave excellent feedback and discussion on the piece. Also thanks to Robert Mitchell who contributed greatly to developing these ideas, particularly on resilience, which will also appear in our forthcoming book “The Smart Mandate”. Finally I want to thank Jamie Allen with whom I worked to develop an earlier presentation that led to this paper for 4S in 2016.

.png,1600)