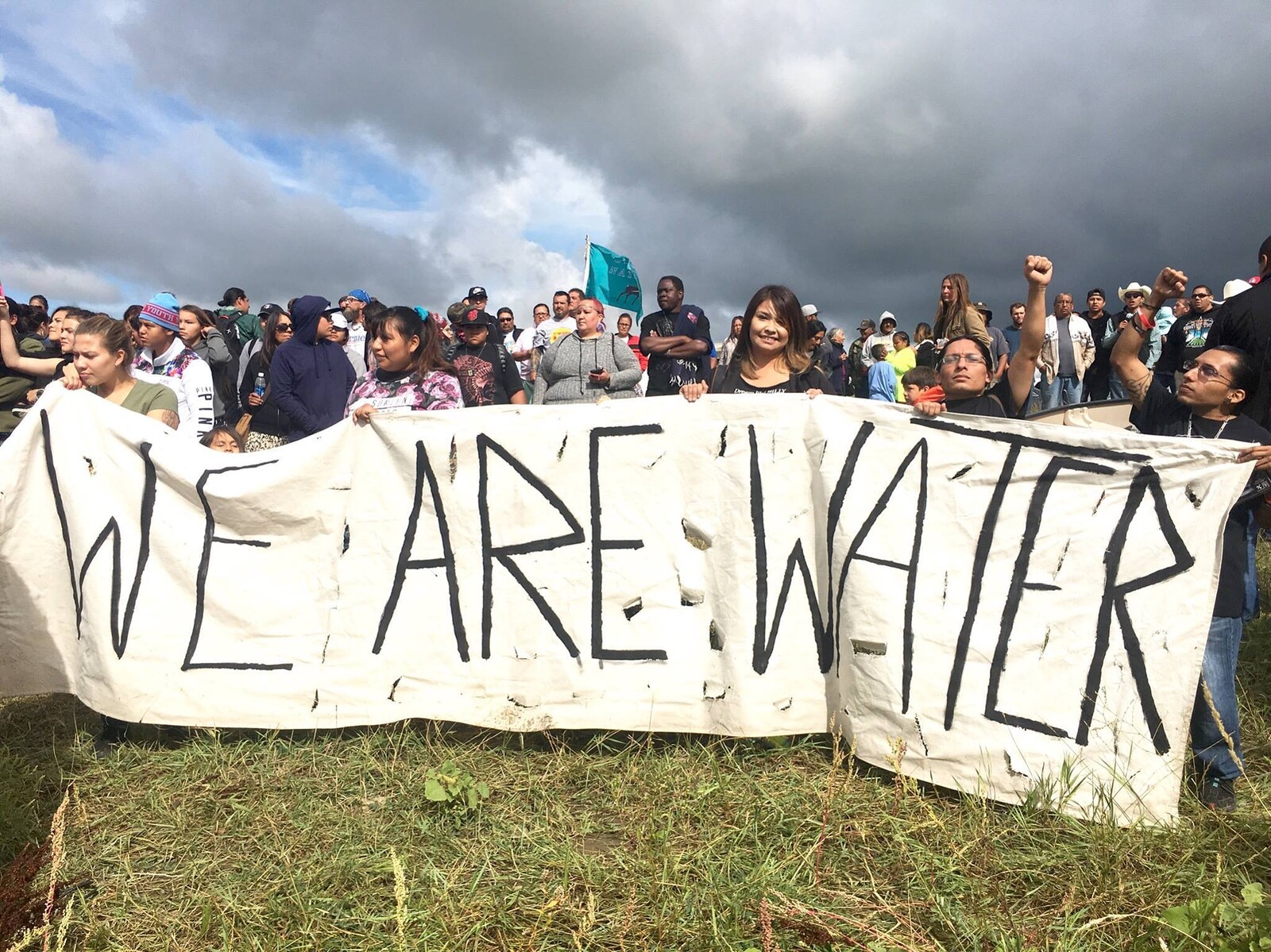

An unprecedented local referendum in 2011 forced the city of Berlin to remunicipalize its water utility after more than ten years of partial privatization. The protest image created in the lead-up to the vote, a reinterpretation of the famous anti-nuclear movement symbol, depicts a mundane infrastructure (a tap), an ordinary resource (a drop of water), and a vociferous shark, Euro-sign gracing its eye.1 What this image brings to life, in essence, is a financial frontier, where value in the form of a humble drop of water is greedily swallowed up by predatory investors. What it also represents is the fact that frontiers of accumulation, while always mechanisms of capture, are also always zones of struggle.2

Privatized water infrastructures are particularly volatile fault-lines of attempted expropriation because they often provoke new resistant collectivities. Plunder is met with refusal and revolt, such that the privatization of water can become a vehicle for the theorization of the limits of this particular attempt at enclosure. Put differently, privatization opens up the possibility that water may, at times at least, refuse liquefaction, even in the most liquid of markets.3

Water is increasingly presented as “the petroleum of the next century,” as Goldman Sachs put it, and “as the single most important physical-commodity based asset class [soon dwarfing] oil, copper, agricultural commodities and precious metals.”4 Such delirious predictions of water’s future value abound, leading banks, pension fund managers, and elite private equity firms—the “new water barons,” as Jo-Shing Yang has called them—to buy up shares in water utilities, especially in larger urban areas in middle-income countries.5 This global liquidity is intersecting with regimes of austerity as cash-strapped cities raise money through debt-financing as their infrastructures crumble.6

Berliner Wassertisch symbol.

This turn to global investors to borrow on international capital markets has had cities, indeed whole countries, exhibit a kind of “pawnshop mentality” as they hock some of their most valuable possessions, like public infrastructures, for a short-term monetary fix.7 After all, the borrowing from global investors (rather than funding infrastructures through a mix of state loans and taxes, for example), comes with a government-backed guarantee of returns that actually ends up increasing government debt.8 But the long run does not matter in a financialized economy that orbits around quick returns. Global investors can rely on states to make sure their returns are furnished by “end-users,” who pay ever increasing prices on vital resources like water. If they don’t, it is the water utility that shuts off the water supply, the police that repress protestors, and the courts that fine the indigent. Wealth created through the financialization of water infrastructures is thus generated and guaranteed through its “trickling up” from the household level to already wealthy global investors.9

Individual households have become central extractive points for finance capital.10 One can thus conceptualize this global push toward financialized infrastructures as a frontier-in-the-making. Frontiers, after all, are never just made at peripheries but also in media res. As household payments for utilities (energy, water, communication) are increasingly bundled and traded on global markets, they have become anchors to which the global financial system is attached.11 It is thus often on the level of the household where “terra nullius is continuously being declared, as if for the first time,” and where wealth is extracted, bit by bit, in the form of ever-increasing fees and bills.12 As ordinary people consume water, the sharks lie in wait.

Such lucrative frontiers do not simply exist; they must be made. Public services first need to be turned into tradable assets in the global market place. This is most often achieved through a specific legal form—the public-private partnership (PPP)—where municipally-owned utilities are transformed into (or embedded within) joint-stock companies such that a part of their shares (often slightly less than 50%) can be offered up to global capital markets.13 This corporate form, benignly called a “partnership,” in fact “institutionalizes the privilege of distant creditors” for decades through long-term contracts that allow for ostensibly public infrastructures to be designed, built, operated, and maintained for private gain.14

300.jpg,1600)

300.jpg,1200)

Anne Lund, Smiling Sun, 1975.

In June 1999, Berlin’s Senate signed a twenty-nine-year contract with French corporation Vivendi (now Veolia) and German energy giant RWE, subsuming Berlin’s formerly-public water utility, the Berliner Wasserbetriebe (BWB), within a complex public-private holding called Berlinwasser Holding AG: Within this holding, the city-state of Berlin held 50.1% of the shares, and Veolia and RWE held 49.9%. Berlinwasser Holding AG was to serve as a pilot project and become a motor of growth for the city of Berlin.15 “Twenty-nine years!,” activists exclaimed to me. “That’s longer than the life-span of the Berlin Wall!” The contract contained what eventually became a notorious paragraph, §23, that guaranteed an ample return on invested capital to investors.16 This profit guarantee was enabled by a partial privatization law that was passed by the city’s parliament in May 1999, yet had been contested in Berlin’s Constitutional Court by Berlin’s Leftist opposition in October 1999.17 The court ruled that parts of the law were unconstitutional because the guaranteed return on investment was too high. As the court put it, the Berliner Wasserbetriebe (BWB) was a public service with a public mandate. It therefore should not adopt the private industry’s “axioms of profit maximization” without hesitation.18 In addition, the return on investment relied on “arbitrary” pricing that stood far from the actual costs that would ultimately weigh on end-users’ bills.

Yet the Senate’s contract, signed and sealed after the Constitutional Court’s ruling, already contained paragraph §23 pledging that all potential losses incurred by investors due to legal rulings or for any other reason would be offset by the city—for the next twenty-nine years. The state thus promised to either renounce its own profits if those of investors’ were to fall short, or to make up for lost profits through recourse to Berlin’s state budget. The city thus made itself—or really, its citizens—fully liable for any potential loss. The scandal that lay at the heart of the contract—a private contract subject to a non-disclosure agreement—was not only that the city had essentially set up a tributary structure that would flow towards private investors for almost three decades (and this just for a short-term loan), but that it had pre-empted due legal process.19 It was as if the Constitutional Court’s ruling had never happened.

Gerlinde Schermer, a German politician from the Social Democratic Party, was one of the few people in parliament who had insisted and won the right to see the contract after it was signed and sealed in 1999. Disregarding the official constraint of a confidentiality agreement, she immediately insisted on speaking publicly about §23 and the profit guarantee it contained.20 But she could not prove that the (secret) contract contained such a guarantee, which is why it became clear that a referendum would be needed to force open the contract and the scandal hidden therein.21 A group of activists came together in 2006 to form the Berlin Water Table, named after founding member Dorothea Härlin visited Venezuela and was inspired by the country’s famous mesas de aguas. Härlin and a group of other activists soon joined forces with Schermer to work toward bringing about such a democratic procedure.

The Berlin Water Table was buoyed by Berlin’s population, which had begun to complain about water prices after they had risen to one of the highest in the country by 2006.22 Berlin’s Senate had modified its laws in 2003 to allow for a novel method to calculate infrastructural depreciation. This led the BWB to miscalculate the rate at which infrastructure depreciates and vastly underestimate the operating life of its equipment. It was estimated, for example, that the city’s sewage pipes would last only thirty-five to fifty years. The utility’s water price reflected this supposedly rapid deterioration and the many future investments the utility would have to make. But in reality, the lifespan of the sewage pipes was approximately 100 years.23 The differences in estimated lifespan were reflected in an accumulated depreciation of €264 million euros (versus the €40 million euros that critics said were necessary). Yet the Berlin Water Table argued that the BWB was not even making the infrastructural investments that were necessary,24 and made the case that Berliners should only be charged for de facto repairs, not “fictive” future investments.25

In 2007, the Berlin Water Table was ready to launch their campaign for a city-wide referendum called “We’re done with secret contracts! Berliners want their water back!” The Water Table had written a disclosure law (“Offenlegungsgesetz”) which would oblige the city to disclose the secret contract. Berlin is somewhat unusual within the larger German landscape in that it had enshrined within its constitution the right of citizens to write their own laws (in effect, become what Berlin’s constitution calls “popular legislators,” or Volksgesetzgeber) and have the population vote on these citizens’ laws through public referenda.26 Yet Berlin’s Senate immediately declared the popular initiative unconstitutional on the grounds that a disclosure of the contracts would violate corporate freedom of competition and freedom of contract, their right to informational self-determination (informationelle Selbstbestimmung), freedom of profession (Berufsfreiheit), and right of ownership (Eigentumsrecht), all of which were guaranteed in the German constitution and thus by what they said was a law that ranked higher (höherrangiges Recht) than the right of citizens to write their own law and thus access the contracts governing the water utility. The Senate argued that the draft disclosure law would “dispossess” (enteignen) shareholders and infringe upon the constitutional rights of private investors.27 The Water Table immediately lodged an appeal against the Senate’s decision with the Berlin Constitutional Court and won the appeal. In a remarkable 2009 ruling, the Constitutional Court insisted that public law ought to be given priority over civil law when it comes to the governance of the public sector, since civil law is used primarily for the protection of private individuals and thus has no place in the governance of common goods (Gemeingüter). The court also insisted that the rights of citizens as law-makers (Volksgesetzgeber) was equivalent to the right of legislators to make laws. As Dorothea Härlin put it to me in a conversation, “it drove the judges nuts that the Senate presumed to be able to make statements on the constitutionality of a referendum. It was the Court’s role, not the Senate, to make that decision.”28

Soon after, the Berlin Water Table proceeded with the referendum. When the day arrived, on February 13, 2011, 98.2% of voters voted in favour of the Water Table’s proposition. Veolia and RWE’s secret water contracts were subsequently disclosed to the public, and the Water Table’s self-written disclosure law was enshrined within the city’s laws. This was the first time that a popular referendum had ever been won in Berlin.

With the previously-secret contract splashed all over the city’s news, the debt-fuelled fiscal orbit around which all social actors—both state and citizen—rotated and toward which all made their fiscal offerings was suddenly laid bare. The financialization of public utilities often entails continuously taking out new loans to repay little more than interest on older, often off-the-books debt. This imperative—indeed, fantasy—of debt repayment has come to dominate public sectors all over the world, and in Berlin resulted in public-sector income and further loans being used to repay interest and deficit arrears that had accumulated after only a few years of privatization.29 It was thus Berlin’s public—its citizens—who were made responsible for the 8% per annum interest on the loan.30 As sociologist Max Weber put it in his 1894 analysis of the stock market, dividends like this are the “vehicles through which tribute to capital is paid”.31

Activists’ insistence that they had the right to see the contracts thus revealed not only the injustice of proprietary corporate information when it comes to common goods like water, or the compulsive ways in which capital and its political allies insist on secrecy and are prepared to defend this secrecy via recourse to the courts. They also revealed, most importantly, the mystified mechanisms whereby the BWB’s profits were achieved, and through which high interest, converted into the rising price of Berlin’s water, ultimately resulted in a tributary structure privileging global investors. For critics, this was nothing but an act of theft; a “Raubzug” (raid or predatory attack) as some politicians called it.32 Indeed, as Schermer repeatedly argued, the high interest rate allowed for private investors to cash in 73% of all profits between 2000–2006, even though they only owned 49.9% of the shares. Berlin had thus partially forgone its own profits in order to ensure the profits promised to private investors; 41.2 million Euros in 2004 alone, to be exact.33

Berliner Wasserbetriebe laying water pipes in Berlin, August 2019. Photo: Andrea Muehlebach.

The act of revelation represented a public humiliation so powerful that the then-ruling Leftist coalition soon agreed to buy Berlin’s water back. One of the Water Table’s unusual achievements, then—an achievement widely recognized and admired by water activists across Europe and beyond—was that they were able to render visible not just the layers of predation hiding behind the ruse of the “partnership,” but some of the mystifications that are constitutive of all financialized public utilities, and of capitalism more generally.34

But challenges remained. The disambiguation of the holding took years and was extremely complex. A large amount of profits laid ensconced in the holding’s many subsidiary companies, and questions regarding the movement of these profits from one subsidiary abounded because of tax implications. This meant that even after the referendum and the public scandal that ensued, the holding continued to exist for years. And while the holding has since been dissolved and the BWB is currently a public law company (Anstalt öffentlichen Rechts), some activists argue that an owner-operated municipal enterprise (Eigenbetrieb) would be better subject to more democratic control.35

Still today, for example, Berlin’s water prices continue to be unusually high, mostly because of the astronomical debts the city incurred after the buy-back.36 While the Federal Cartel Office ordered a 15% price reduction in 2014, the water utility’s high returns continue to service debts—not just of the BWB but of the city more generally. Activists thus continue to accuse the BWB of secrecy and veiling. Just as the partially-privatized utility obscured its de facto profits, so does the now re-municipalized utility obscure the fact that its high water prices in fact entail a “hidden water tax” that continues to service government debt.37

The Water Table, together with a more recently founded Water Council (Wasserrat), have since been fighting for meaningful participation in the utility’s governance structure.38 The 2018 transformation of the BWB into a “Blue Community” means that the BWB are now publicly committed to water as a common good and to the recognition of water and sanitation as a human right. Concretely, this means promoting publicly financed, owned, and operated water and wastewater services and the banning of the sale of bottled water on municipal facilities and events.39

What remains is not only a demand for democracy, but also a more general call for a properly “social infrastructure,” as both Schermer and Carl Waßmuth, an engineer allied with the Berlin Water Table and founding member of Gemeingut in BürgerInnenhand (“Common Goods in Citizens’ Hands”) have named it.40 Not unlike the shipyard workers along the Hooghly River in India who insisted on a philosophy of social wealth and radical mutuality,41 Waßmuth insisted on the collective need to understand the ways through which “our social life is intimately intertwined with infrastructure.”42 Would it be possible, he asked, to develop a new poetics around infrastructure, “an infrastructure we might properly appreciate again, not just because of its foundational contribution to social life but because much of it was built over decades by us, citizens and tax-payers?”43 One serious challenge to the future of public utilities, Waßmuth noted, was to escape austerity’s reverence for debt financing, and to recuperate a sense of infrastructure as an inheritance that is collectively bequeathed over generations; as a kind of inalienable social property that hinges on not a business but a social contract.44 Is it possible to replace the culture of debt worship with a veneration of infrastructure as common good?

Toward these ends, Waßmuth spoke to me of an expressionist poem by Georg Heym called “God of the City” (Gott der Stadt), written at the beginning of the twentieth century. The poem is centered on a smokestack sitting in the middle of the modern city and around which all city life is assembled as if kneeling in prayer, offering itself up to this central piece of infrastructure, with church bells chiming in its honor. Here, Waßmuth conjured a kind of tributary structure diametrically opposed to the one set up by the payment of dividends. Rather than pay tribute to the market, society should pay tribute to that which holds it together, socially and materially—its infrastructure—and translate that tribute into maintenance and care.

Waßmuth explained that urban infrastructure is continuously used and used up. “It needs investments that are furnished regularly and not in sudden bursts once the infrastructure has been depleted after of years of austerity and frantic debt repayments.”45 He described two different gradation models of more-or-less appropriate infrastructural care. The first entails an “unwise” mode of investment, in which investment takes place all at once, and therefore neglected infrastructures must be fixed through loans. Debts and high interest must be repaid, diverting money that could otherwise be invested elsewhere. The second investment model, in contrast, sees government money spent “wisely,” in that infrastructure is continuously invested in. Government money is only partially diverted into financial markets, or not at all, and only for very short periods of time.

According to Waßmuth, what Berlin, and Germany more generally, needs, is not just a different fiscal philosophy based on progressive taxation and a political commitment to genuinely public services, but a commitment to its infrastructure as a kind of intergenerational social property.46 In this model, collective wealth is not extracted but re-grounded. It is a social contract made and remade materially through continuous infrastructural care; a future built not through debt to global investors but through obligations to future generations.

See ➝.

For another version of this piece, see Andrea Muehlebach, “On Possession, Use, and Financialized Infrastructure,” Fieldsights (March 29, 2019). ➝.

Melinda Cooper and Angela Mitropolous, “The household frontier,” Ephemera Theory and Politics in Organization 9, no. 4. (2009): 363–368, ➝.

Karen Bakker, “Neoliberal Versus Postneoliberal Water: Geographies of Privatization and Resistance,” Annals of the Association of American Geographers 103, no. 2 (2013): 253–260, 254.

Jo-Shing Yang, “The New ‘Water Barons’: Wall Street Mega-Banks Buying Up the World’s Water,” Commodity Trade Mantra (2014), ➝.

Laura Bear, “‘Alternatives’ to austerity: A critique of financialized infrastructure in India and beyond,” Anthropology Today 33, no. 5 (2017): 3–7; Jamie Peck, “Austerity Urbanism. The Neoliberal Crisis of American Cities,” Rosa Luxemburg Stiftung, May 2015, ➝.

This expression was used by Carl Waßmuth, a structural engineer, in conversation with the author in March 2016.

It is often cheaper for governments to borrow from banks—but it would mean that their debt would be on the books, and thus add to public debt (anathema in the age of austerity). Borrowing from private investors (with private investors going to banks for loans) is more expensive but moves debt off the books (preferred under regimes of austerity). The latter represents a form of hidden, off-balance-sheet financing that comes with often decades worth of debt due to contractually guaranteed returns for investors.

Kate Bayliss, “The Financialization of Water,” Review of Radical Political Economy 46, no. 3 (2013): 292–307.

Cailtin Zaloom, “Finance,” Cultural Anthropology, August 7, 2017, ➝; Cooper and Mitropolous, “The household frontier.”

Mike Beggs, Dick Bryan, and Michael Rafferty, “Shoplifters of the World Unite! Law and Culture in Financialized Times,” Cultural Studies and/of the Law 28, no. 5–6. (2014): 976–996. Andrew Leyshon and Nigel Thrift, “The Capitalization of Almost Everything,” Theory, Culture & Society 24, no. 7–8. (2007): 97–115.

Cooper and Mitropolous, “The household frontier.”

The transformation of Berlin’s public water utility (BWB) into a joint-stock company was anathema to unions when it proposed in 1994. See Klaus Lanz and Kerstin Eitner, “D12: WaterTime case study- Berlin, Germany,” WaterTime, January 31, 2005, ➝; Alexis Passadakis, “Die Berliner Wasserbetriebe: Von Kommerzialisierung und Teilprivatisierung zu einem öffentlich demokratischem Wasserunternehmen. Studie im Auftrag von Sahra Wagenknecht,” Vereinigte Europäische Linke (2006): 17–22, ➝. The Berlin Senate therefore created a quite unusual but more politically palatable nested corporate structure in 1998—a complicated holding called Berlinwasser Holding AG that allowed Veolia and RWE to partake in the BWB, which was still a public law company (Anstalt öffentlichen Rechts).

Jamie Peck and Heather Whiteside, “Financializing Detroit,” Economic Geography 92. no. 3 (2016): 235–268, 246; Laura Bear, Navigating Austerity: Currents of Debt Along a South Asian River (Stanford: Stanford University Press, 2015); Bear, “Alternatives’ to austerity.”

As Gerlinde Schermer laid out in many pamphlets and papers over the years, private investors were at least initially guaranteed profits according to an “R + 2” formula (which de facto resulted in an annual profit rate of around 8%—a rate similar to the profit rates enjoyed by privatized water companies in England and Wales. See also R. Beveridge and M. Naumann. “Global norms, local contestation: Privatisation and de/politicization in Berlin,” Policy and Politics 42, no. 2 (2014): 275–291, 282.

Alexis Passadakis, “Die Berliner Wasserbetriebe”; Beveridge and Naumann, “Global norms, local contestation.”

The city was ruled by the rot-rot (SPD/CDU) coalition. Opposition was the PDS party (now called the Party of the Left, Die Linke) and the Greens (Bündnis 90/Die Grünen).

Sebastian Heiser, “Berlin: Die geheimen Wasserverträge,” Informationsfreiheitsgesetz, October 30, 2010.

Beveridge and Naumann, “Global norms, local contestation.”

Author interview with Gerlinde Schermer, October 30, 2014.

The Wassertisch chose this route because popular initiatives were at the time prohibited from intervening into ongoing budgetary issues pertaining to the city. This limitation was eventually overturned by Berlin’s Constitutional Court.

As Water Table ally and Green politician Heidi Kosche would later argue, 45% of Berlin’s water costs were in fact made up of “fictive costs.” Heidi Kosche, Endabrechnung Wasserprivatisierung (MdA der Fraktion Bündnis 90/Die Grünen im Abgeordnetenhaus von Berlin, 2014).

Ibid.

“Fictive costs” are a common problem with PPPs. For a detailed investigation of the decline in infrastructural investments under the PPP-model in Germany and beyond, see Jana Mattert, Laura Valentukeviciute, and Carl Waßmuth, Gemeinwohl als Zukunftsaufgabe: Öffentliche Infrastrukturen zwischen Daseinsvorsorge und Finanzmärkten, (Heinrich Böll Stiftung, 2017), 36–37, ➝.

Kosche, Endabrechnung Wasserprivatisierung.

Beveridge and Naumann, “Global norms, local contestation.”

See ➝.

Author interview, Berlin, August 25, 2019.

See also Bear, Navigating Austerity; Alexa Färber, “Low-budget Berlin: towards an understanding of low-budget urbanity as assemblage,” Cambridge Journal of Regions, Economy and Society 7, no. 1 (2014): 119–136.

Laura Bear, Navigating Austerity.

Max Weber, “Stock and Commodity Exchanges,” Theory and Society 29, no. 3 (2000 {1984}): 305–338.

Klaus Lederer, “Die Teilprivatisierung der Berliner Wasserbetriebe: Erfolgsmodell oder Abwicklungsfall?,” Journal for Public and Nonprofit Services 34, no. 4 (2011).

Data found on a pamphlet written by Gerlinde Schermer and distributed to her colleagues in Berlin’s parliament. Received by the author in September 2015.

Laura Bear, writing about financialized infrastructure in India, speaks of three layers of predation on the part of the private sector. First, it benefits from investing and trading in infrastructure bonds, thus “making profits from the ruins generated by fiscal austerity.” Second, it benefits from the outsourcing of public work and selling of public assets. And third, companies running or constructing infrastructure gain guaranteed profits through taxpayers’ revenues. All of this is rendered invisible through contracts that are invisible to the public. See Bear, “Alternatives’ to austerity.”

Ulrike Von Wiesenau, “Zwischenbilanz des Berliner Wasserrates,” Neue Rheinilche Zeitung, 2019, ➝.

Beveridge and Naumann, “Global norms, local contestation.”

Von Wiesenau, “Zwischenbilanz des Berliner Wasserrates.”

The Wasserrat (Water Assembly) was founded in 2013 as a forum for all those interested in promoting the democratic participation of Berlin’s citizens in the newly remunicipalized BWB.

The Blue Communities project was initiated by the Council of Canadians and the Canadian Union of Public Employees in 2009, and encourages municipalities to support the idea of water as a common good and to recognize water and sanitation as a human right. Concretely, this means promoting publicly financed, owned, and operated water and wastewater services and banning the sale of bottled water on municipal facilities and events. See “Blue Communities, The Council of Canadians,” ➝.

See “ÖPP/PPP (4.0): Die Gesetzesvorschläge der ‘Expertenkommission,’ der Bauindustrie, der Banken und von Bundeswirtschaftsminister Gabriel Eine Analyse der Gesetzesvorschläge für die Sommerakademie Attac 2015,” August 5, 2015, ➝.

Laura Bear, Navigating Austerity.

Author interview with Waßmuth, March 18, 2016.

Ibid.

Financialized infrastructure became a “public object of knowledge” in a 1994 World Bank report on Infrastructure for Development, which explicitly argued that infrastructure was a private rather than a public good that ought to be consumed by populations like any other commodity. See Bear, “’Alternatives’ to austerity.”

Author interview with Carl Waßmuth, March 18. 2016.

Mattert, Valentukeviciute, and Waßmuth, “Gemeinwohl als Zukunftsaufgabe.”

Liquid Utility is a collaboration between e-flux Architecture and the Temple Hoyne Buell Center for the Study of American Architecture at Columbia University as part of their project “Power: Infrastructure in America.”